40+ which credit score is used for mortgage

However having a higher credit score may still help you qualify for a better FHA mortgage rate. Get Instantly Matched With Your Ideal Mortgage Lender.

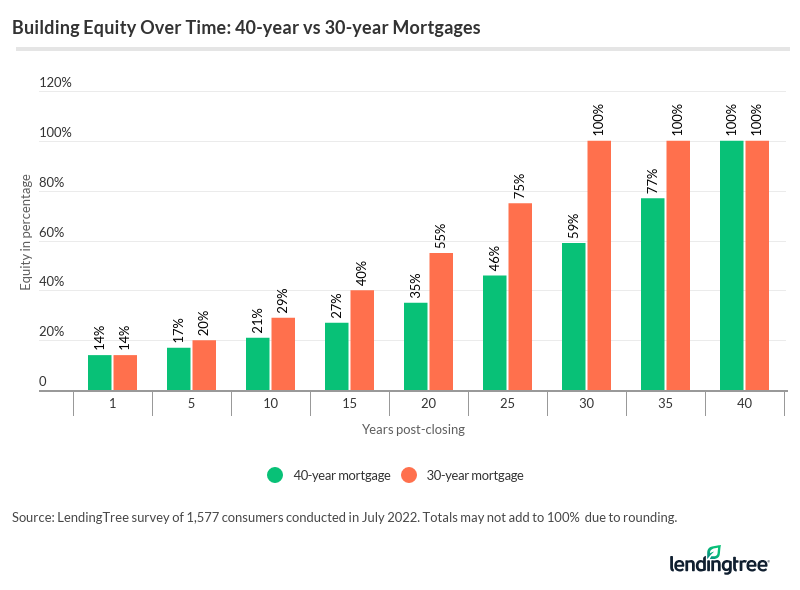

What Is A 40 Year Mortgage Lendingtree

Most lenders require at least a 620.

. The credit score you need to refinance depends on the mortgage lender you work with your individual. Web In fact there are 16 different FICO Scores with dozens of variations of each score. Ad Check Your FHA Mortgage Eligibility Today.

Web Typically consumer credit scores only use information from one of the credit bureaus. 800-850 Very good credit. Web Heres a breakdown of the five categories of FICO scores.

Low- to moderate-income homebuyers. Use NerdWallet Reviews To Research Lenders. Exceptional Your credit is near perfect.

Web The FICO Score 8 is the most widely used credit score and its the score that lenders are most likely to use when considering your mortgage application. The Experian Credit Score is based on the information in your Experian Credit Report. Web No credit minimum from USDA but 640 is common.

Web Lenders will have different credit requirements too though youll typically need a FICO credit score of at least 640 to qualify for a 40-year fixed-rate mortgage. Web Your credit score also called a FICO Score can range from 300 lowest to 850 highest. Lock Your Rate Today.

Equifax FICO Transunion Classic 04 Hard credit check. Web FICO is the scoring model used by mainstream mortgage lenders. Pinpoint whats most affecting your scores.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Web For example some mortgage lenders may prefer to deal only with applicants with credit scores above 740considered very good or exceptional on the FICO Score scale. However a higher score significantly improves your.

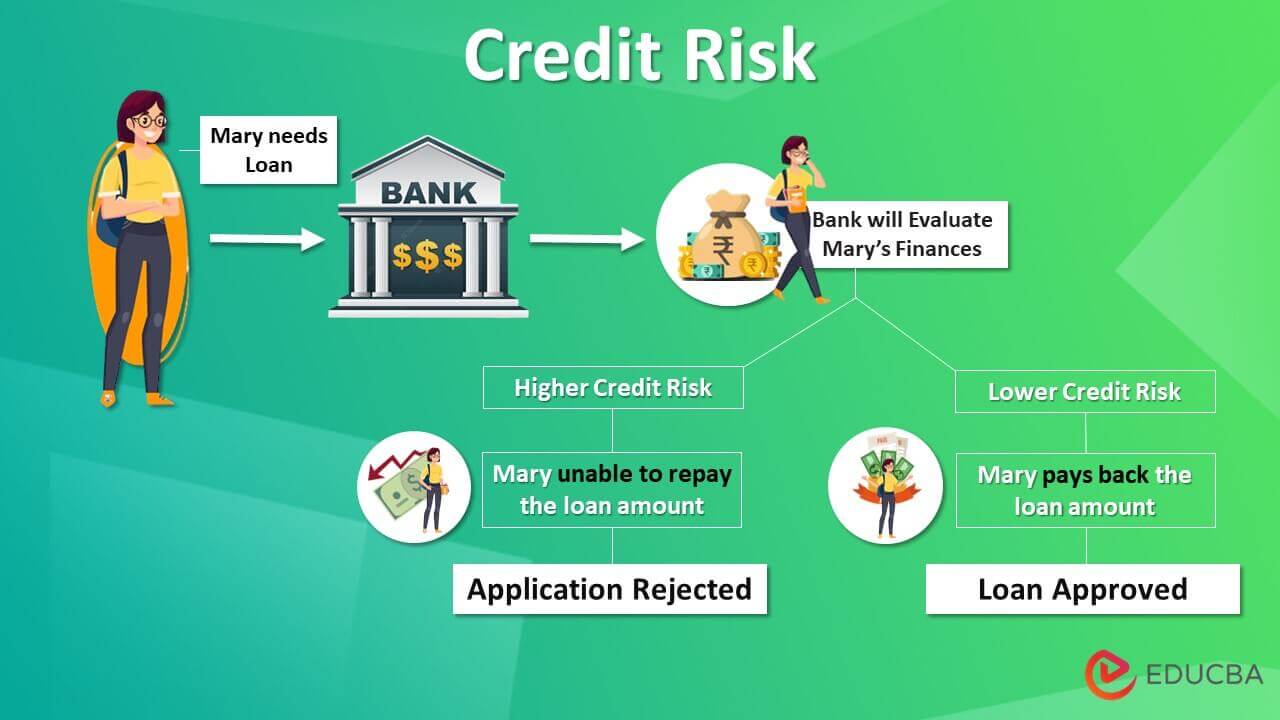

Lenders collect credit and financial information including credit history current debt and income. Lenders consider you an exceptional. Increase your Credit Scores Get Credit for the Bills Youre Already Paying.

A score of 740 or above is generally considered very good There are three national. Web What credit score is needed to buy a house. Take Advantage And Lock In A Great Rate.

Ad View Your Latest Credit Score Report In Seconds. Lock Your Rate Today. Your credit score comes from the information found on your credit report.

On conventional conforming loans which must adhere. Web The minimum credit score for an FHA loan is usually 580. Ad 10 Best Home Loan Lenders Compared Reviewed.

We fill in the gaps that other credit score providers simply dont. Its Quick Safe. If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You.

500 with 10 down. Free Credit Monitoring and Alerts Included. Get Instantly Matched With Your Ideal Mortgage Lender.

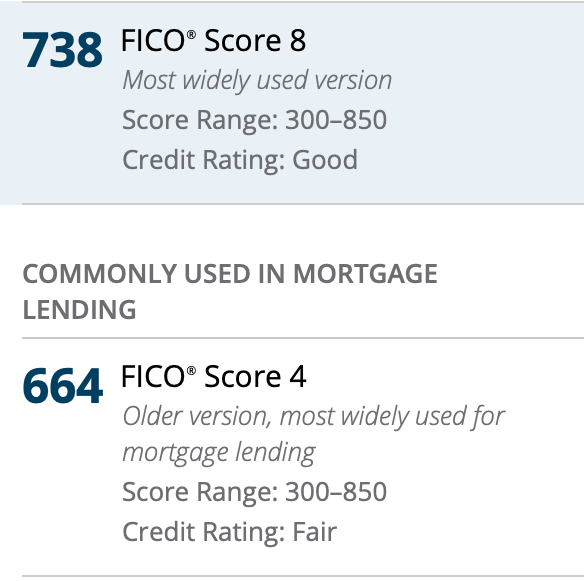

Ad Take out the guesswork with credit. Web The most widely used version is FICO Score 8 but the most frequently used versions in mortgage lending are. FICO Score 5 or.

Savings Include Low Down Payment. Ad New Credit Scores Take Effect Immediately. Web Pre Approved Mortgage - Top Results Find More at Searchley.

FICO Score 2 Equifax. FICO scores for mortgage. Ad Easier Qualification And Low Rates With Government Backed Security.

Web The FICO scores that mortgage lenders commonly use according to Experian are. Contact a Loan Specialist to Get a Personalized FHA Loan Quote. Web 5 factors determine your credit scores.

While each lender is free to set its own rules many will follow. If an item does not show up on a credit report it. 580 with a 35 down payment.

Comparisons Trusted by 55000000. Does Getting Preapproved Hurt Your Credit Rocket. It runs from 0-999 and can give you a.

Comparisons Trusted by 55000000. Ad 10 Best Home Loan Lenders Compared Reviewed. Web What is a good credit score to get a mortgage.

FICO Score 2 or ExperianFair Isaac Risk Model v2. Additionally theyre calculated using consumer scoring models rather than. Web On a joint mortgage all borrowers credit scores matter.

Each credit scoring model interprets the information in your credit profile differently aiming to. For most loan types the credit score needed to buy a house is at least 620. Web Generally speaking borrowers with credit scores of 760 or higher get charged the lowest interest rates.

Web So lenders will look at the range in which your score falls and adjust your rate and fees accordingly. Ad Turn A Portion Of Your Homes Equity Into Supplemental Cash With A Reverse Mortgage Loan.

The Ideal Credit Score To Buy A House In 2023 Quicken Loans

What Credit Score Is Needed To Buy A Home

Credit Utilization Ratio What It Is And How It Affects Your Credit Score The Points Guy

The Credit Score You Need To Take Out A Mortgage

Funding Update Affordability Rls 3 0 And Credit Score Requirements

How To Get A Mortgage With Bad Credit Comparewise

Which Credit Score Do Mortgage Lenders Use

Credit Risk How To Measure Credit Risk With Types And Uses

What Average Credit Scores Needed For Your Loans Mybanktracker

Heritage Home Loans Hhlnorthwest Twitter

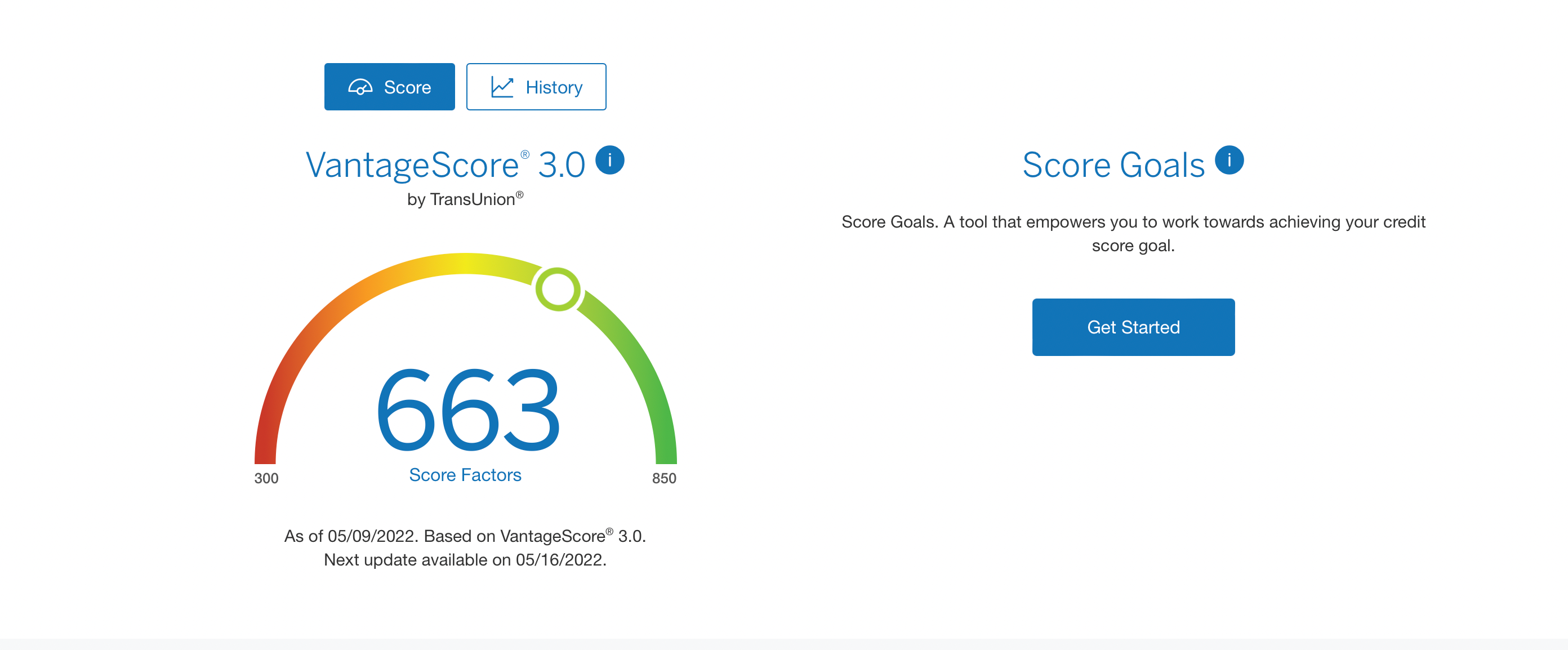

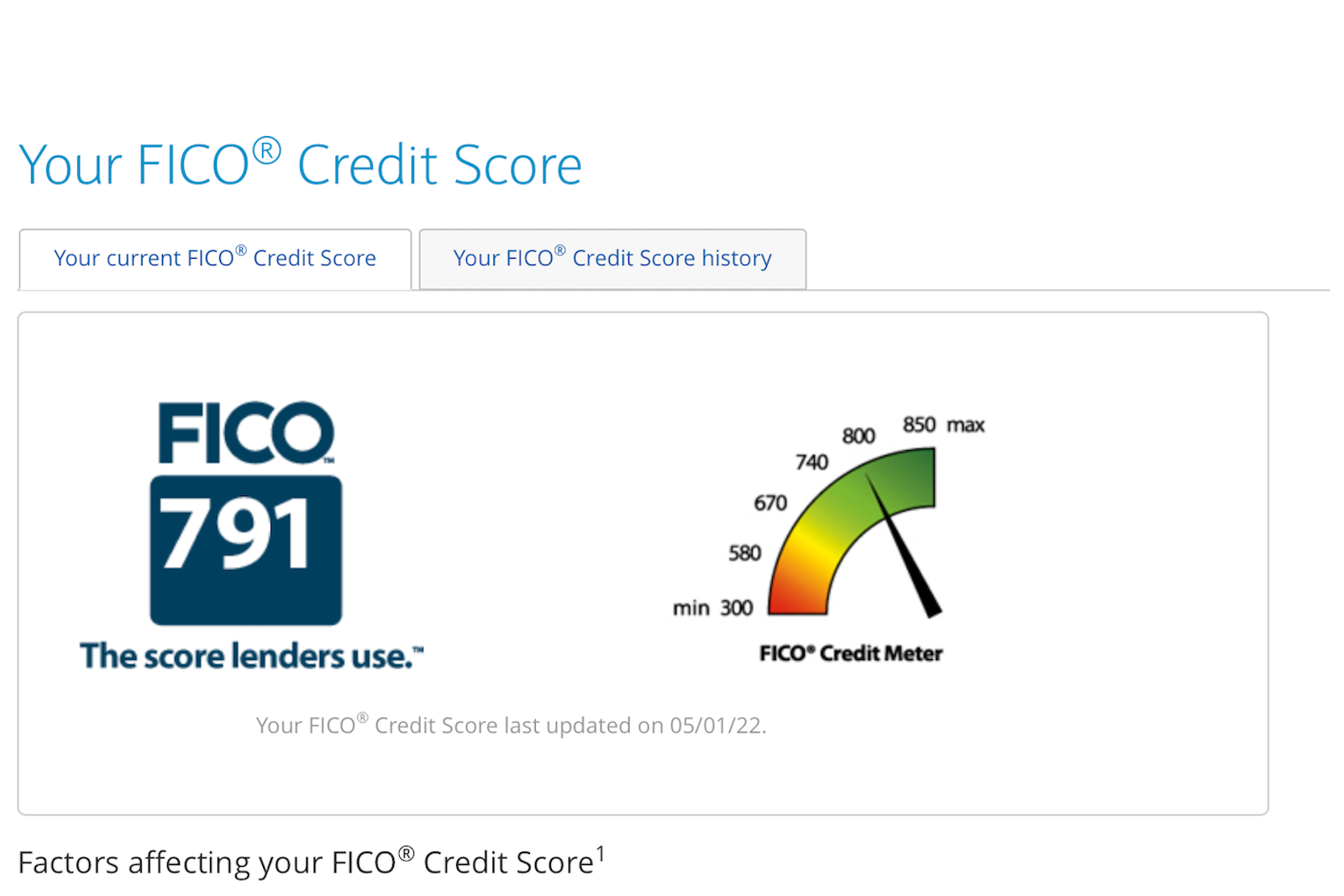

Clearing Up Confusion Why Your Credit Score May Be Different Depending Where You Look The Points Guy

Clearing Up Confusion Why Your Credit Score May Be Different Depending Where You Look The Points Guy

The Ignorance Of People 40 Today You Can T Even Have A Conversation Without Them Gaslighting You Into Thinking The Market Is Affordable For Young People R Canadahousing

Paying Off All But 3k Of Debt Dropped My Tu Mortga Myfico Forums 6180302

What Credit Score Do You Need To Get A Mortgage Learn The Key Fico Thresholds

What Credit Score Is Needed To Buy A House Smartasset Com

Insurance Your Credit Score Matic